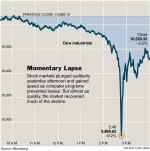

The thud you heard on Thursday was a 1,000 point drop in the Dow which then recovered 650 of those points in a matter of minutes. So what happened? Within hours, we got to hear all sorts of excuses such as a Citi trader fat figured a sell order for 1 billion instead of 1 million. Then the next round of excuses were about “algo black boxes” making a bad situation worse.

The thud you heard on Thursday was a 1,000 point drop in the Dow which then recovered 650 of those points in a matter of minutes. So what happened? Within hours, we got to hear all sorts of excuses such as a Citi trader fat figured a sell order for 1 billion instead of 1 million. Then the next round of excuses were about “algo black boxes” making a bad situation worse.

If these orders were executed within milliseconds, then how the hell are we still trying to figure out the cause 48 hours later. I’m sure a lot has todo with ECN’s, which is where about 60% of all trades now take place. ECN’s provide a way for traders to be not so transparent with their trades. If algorithmic trading funds are called black boxes then ECN’s are the mother of all black boxes.

What we have experienced over the past 18 months in the financial markets seems to have a similar thread – transparency. The entire CDO complex was opaque since they were not listed on an exchange and only after it blew up did we start to learn what was happening.

True transparency leads to quicker price discovery and that’s the problem. You can’t make a boat load of money if everyone knows what you are doing. That’s the struggle of Wall Street vs Main Street, Wall Street likes the current structure and Main Street wants to open it up. Since the sub-prime meltdown NOT ONE rule has been passed to regulate the CDO market, however the US Government has bailed out Wall Street to the tune of over $1 Trillion.

I really hope the SEC makes an example of this ridiculous 1,000 point dip and specifically names the client, the broker/dealer and where the trades took place. Let the transparency begin with this government inquiry.

Manish, I looked through the order-by-order update on P&G stocks on Nasdaq for the day. It did not seem to me that some tremendous amount of trading took place around 2:46 PM. What I did see happen was the complete disappearance of bids with the spreads reaching as much as $5-$6 several times for a couple of seconds each, followed by lower and lower offers.

While the fall was definitely exacerbated by programs (I doubt humans can react so quickly and on such a massive scale across so many asset classes and names). The trigger could have been a human mistake followed quickly by pair/portfolio trading programs – then triggering preset stop-losses for programs with long positions further exacerbating the fall etc. In all likelihood, the fall was stopped and the recovery triggered by human intervention when some people must have realised that the President had not really been assassinated and Greece hadn't defaulted (yet).

I think it should be a quick study to determine which security(ies) were the first to be hammered on heavy volumes. That should be a good starting point for a further investigation.

Manish, I looked through the order-by-order update on P&G stocks on Nasdaq for the day. It did not seem to me that some tremendous amount of trading took place around 2:46 PM. What I did see happen was the complete disappearance of bids with the spreads reaching as much as $5-$6 several times for a couple of seconds each, followed by lower and lower offers.

While the fall was definitely exacerbated by programs (I doubt humans can react so quickly and on such a massive scale across so many asset classes and names). The trigger could have been a human mistake followed quickly by pair/portfolio trading programs – then triggering preset stop-losses for programs with long positions further exacerbating the fall etc. In all likelihood, the fall was stopped and the recovery triggered by human intervention when some people must have realised that the President had not really been assassinated and Greece hadn't defaulted (yet).

I think it should be a quick study to determine which security(ies) were the first to be hammered on heavy volumes. That should be a good starting point for a further investigation.