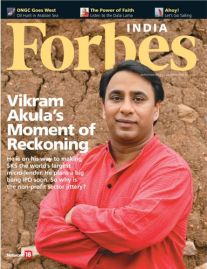

The dust has settled between SKS Microfinance and Vikram Akula and the verdict is in…a complete disaster for investors in the public markets. Rewind back to 2009 when Akula was the poster boy for microfinance institutions (MFI) and was on the cover of Forbes India. A year later SKS went public on August 10, 2010 at Rs. 935 a share and closed at Rs. 1171 for a gain on the first day. Today, SKS is trading at under Rs. 100 a share, down over 90% from its peak of Rs. 1407. Akula has since resigned from SKS and investors are resigned to the fact that they lost a lot of money during the IPO. So what happened?

The press has had a couple theories of that went wrong, one of them states there was a power struggle between Akula and the duo of CEO (Rao) and CFO (Raj). The SKS model is similar to other MFI’s in that they loan small amounts largely to village women and then the village women ensure they all pay off the loan with interest. It’s a great way to push the risk management down to the village level. This has been done successfully for many years and continues to do well. What hurt SKS more then anything else was being a publicly traded company.

When you have shareholders, their goals are pretty simple – grow the top line revenue, grow the bottom line profits which will lead to a higher stock price. In order to do that at SKS you have to find more people and give out more loans, which is very similar to what caused the economic crisis of 2008. If the investment banks wanted to sell more mortgaged backed securities (MBS) they needed more loans which meant the lending standards were relaxed – if you had a pulse you got a loan. With SKS something similar happened, they were giving loans to anybody and everybody in the state of Andhra Pradesh. Some people had 4-5 loans outstanding and those people couldn’t manage to pay them back. This led to SKS reporting less than impressive quarterly numbers which led to a downward spiral of their stock price. In addition, once the government realized people had multiple loans and SKS was charging as high as 36% in interest they hit the pause button on the SKS business model. This again led to the stock price getting pushed down even further.

I believe SKS would have been fine if they remained a for-profit but privately held company. I can understand the founding team of SKS wanting an IPO as it provides an excellent liquidity event for them to cash out, however the short term goals of the investors are completely out of sync with the long term mission of what SKS was trying to achieve.

1 Comment