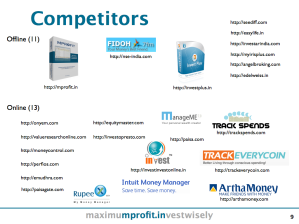

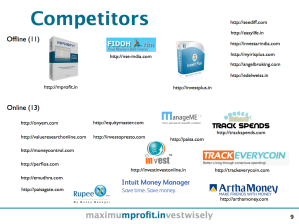

It’s another day and another personal finance startup shuts down in India, this time it’s InvestoPresto. Several Indian focused technology blogs (NextBigWhat and TechCircle) have reported a couple other names of startups that have recently shut down – Moneysights and Paisa.com. That’s only half the story, as part of a VC pitch deck from several years ago I listed all of MProfit’s competitors and honestly I think only half of them are still around.

It would be easy to blame the ecosystem, government regulations, the VC industry or the lack of consumer awareness but then you are just kidding yourself. Forget about India for a moment, I know its an emerging market with 1.3 billion people and the opportunity is so ripe but let’s focus on America. Please tell me how many internet focused financial startups in the US have made it big either via a large user base or an exit? The answer would be simply one – Mint.com which exited at USD 180 million to Intuit.

For all the talk about Americans having a do-it-yourself culture for financial services that assumption is just plain wrong. Most Americans like Indians have no clue where to invest and don’t have the long term disciple for personal finance. Americans love houses and cars. Indians love insurance and gold.

So back to India. In the 4 years we have run MProfit, there are 3 general buckets of potential consumers that visit our site or call us. 1. Looking for tips/signals 2. Technical analysis 3. Portfolio management tool. The first group has been misled thinking that tips or trading signals actually work, they work till they stop working. I could go on and on about them but I’ll spare you the rant. Group two are investors that are putting some thought into their trading/investing style and a group we don’t target as there are many tools already available.

Group three is where we spend the bulk of our time and really try to understand what customer wants. We do have a segment of our customers that use MProfit and crave it, but it’s a small segment. And, that’s the trap that many personal finance startups face – a revenue generating product with limited appeal. We are still trying to create a product that has mass market appeal which people need like oxygen and willing to pay for.

No doubt the market is brutal but I still think around the world, no one has cracked the product/market fit for a comprehensive personal finance tool. A startup’s sole purpose is to figure out the market and create a product for it. The question is whether the need for such a tool exists or is it just a mirage?