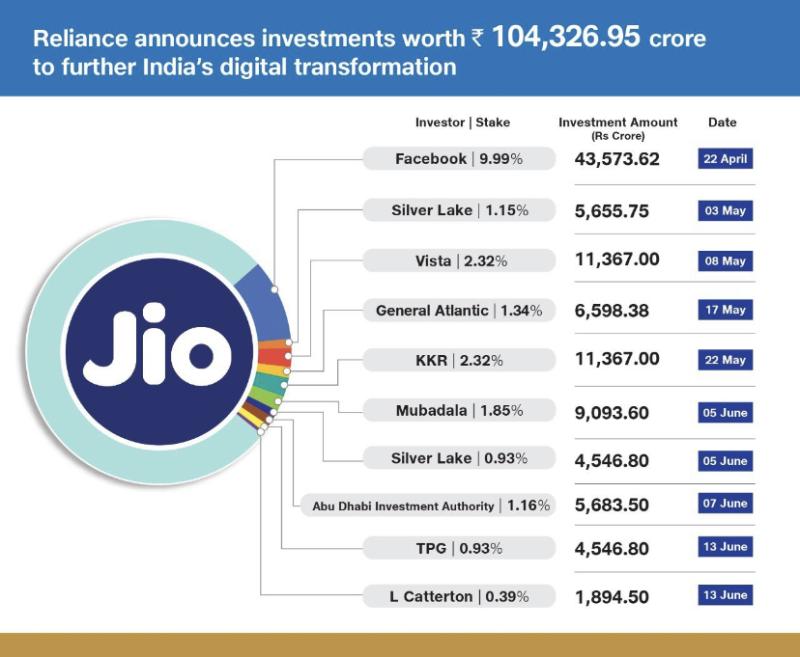

Wow! That is all I can say when you look at the investments that Mukesh Ambani has received for Jio – it’s mind blowing. In a matter of 6 weeks, he has sold around 22% of Jio for USD $14 billion…and from some of the biggest names in private equity and sovereign wealth funds. Jio will get listed in 2021 in what will surely be a blockbuster listing and most likely on a foreign exchange.

As a close friend mentioned, what Ambani has created is “just” a network of dumb pipes. Dumb pipes refer to a data network that transfers data from point A to point B and provides no other value added services. Yes, Jio has many apps (JioMoney, JioTV, JioSaavn, etc…) that users can download, but the real value add of Jio is the magic of Mukesh Ambani and company. So when people say “just”, I laugh. Jai Jio!

Jio Pricing

Say what you want about Mukesh Ambani but Jio really kicked off the internet revolution in India. Before Jio, people would be tracking their daily internet usage which led people to not watch or consume much content on their mobile phones. At that time, the mobile phone providers were selling 1GB or 2GB data packs and that was for the entire MONTH….how f’in primitive.

When Jio arrived in 2016 their “beta” pricing was dirt cheap and they offered 20GB to 60GB per month. I remember when Jio was launched my Vodafone bill dropped to Rs. 299, which is what I still pay per month. I don’t even know how much data they give me or minutes of voice because I stopped tracking all of that.

At one of the startups I advise, the internet connection went down and people were hesitant to share their mobile WiFi hotspot because data was expensive in the pre-Jio era. A couple years later at the same startup the internet connection went down again and this time EVERYBODY was sharing their connection because most had switched to Jio with the big data packs.

Multi-billion Dollar Question

The real question is once Jio gets spun off from Reliance Industries (RIL) and gets listed, what happens to the stock price of RIL? I have yet to see any stock analyst that tracks RIL even formulate that question or have the balls to ask Mukesh bhai about it.

Sidenote – Lucky Number 9

The latest investment into Jio came from private equity firm L Catterton. The “L” in L Catterton is of the LVMH Moët Hennessy group which used to have it’s own private equity arm. It merged with Catterton in 2016 to form L Catterton.

If you look closely at the amount they paid – Rs 1,894.50 Cr (USD $252 million), it’s a weird number. Why not Rs. 1900 Cr? If you add up the numbers of 1+8+9+4+5 it equals to 27 and if you add 2+7 it equals to 9…which is Mukesh Bhai’s favorite/lucky number. In fact many of the previous investments into Jio also reduce to the number 9.