If you know me, you know I’d rather be writing about a $38.5 million Ferrari or the latest Concours d’Elegance.…

The Oberoi Concours d’Elegance: Where Cars Are Art and Stories Are Everything

Last month, I was invited to the 2nd edition of the Oberoi Concours d’Elegance at the Oberoi Udaivilas in Udaipur,…

Transforming Wealth Management with AI Tools

In the world of AI, everything is cool until it hits your area of expertise. I saw the recent announcement…

The $38.5 Million Car: When Passion Becomes a Non-Traditional Asset Class

Excuse me while I blog about what I love and not give a damn about current topics, SEO or even…

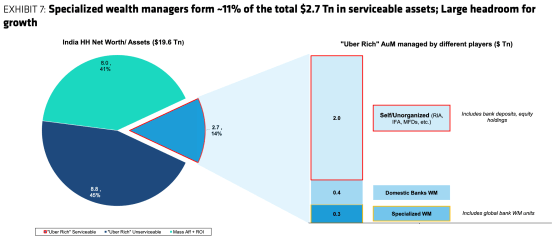

The Rise of the Uber-Rich: India’s $2.7 Trillion Moment

I was recently diving into a detailed report from Bernstein about the state of wealth in India, and one number…

Your Startup: No One Gives a Shit (NO GAS)

WARNING: Hard to believe but this blog post has nothing to do with cars! When you are starting something new,…

Family Office Summit in Bengaluru

Recently, MProfit took part in the Transformance Forums Family Office Summit in Bengaluru. It was a gathering of around 100…

20 Years in India: Embracing the Unexpected

When I boarded my flight in Los Angeles and landed into Bombay on October 1, 2005, it was for a…

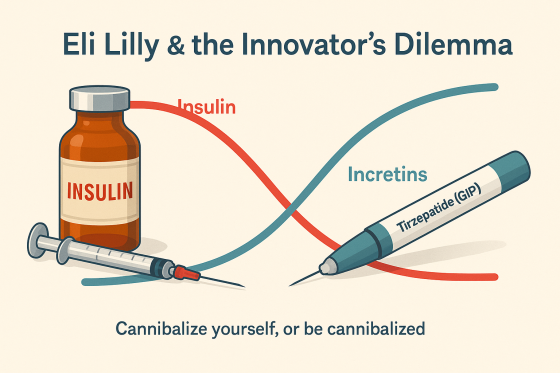

Eli Lilly’s Innovator’s Dilemma: Insulin and GLP-1s

Clayton Christensen’s Innovator’s Dilemma argues that great companies stumble not because they can’t innovate, but because they protect their profitable…