Since the financial meltdown of 2008 I’ve been trying to pull my thoughts together around the idea that long term … More

Month: November 2010

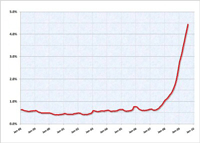

Hockey Stick of Growth

When an entrepreneur starts a company one of the things they all secretly dream about is the hockey stick of … More

Apple Simplicity, Dell Stupidity

Some people say Steve Jobs can see the future and others say he is an amazing marketer. I would agree … More

Got a Question?

The internet has made it easy to get information on almost anything with the help of search engines like Google. … More