Over the past 18 months I’ve been hearing more and more people talk about WealthTech, which is short for wealth technology. Which refers to the segment of FinTech (financial technology) that focuses on providing digital solutions and tools to help individuals, financial advisors and family offices manage investments, financial planning, and wealth management.

If you run a Google Search or ask ChatGPT what WealthTech is, you will get a wide variety of answers and you will end up more confused. To make it really simple, WealthTech boils down to 3 key areas:

- Pre-Trade – Advisory

- Trade Execution – Who and where does the trade take place

- Post-Trade – aggregating all the data such as trade statements, real-time asset tracking, accurate capital gains and overall portfolio wealth and health reports

Over the years I have seen many companies and startups try to master all 3 areas and end up being a jack of all trades and master of none. If I were giving my money to someone to manage I would make sure that the pre-trade advisory part was the most important part since I’m hiring someone to help me manage and grow my wealth.

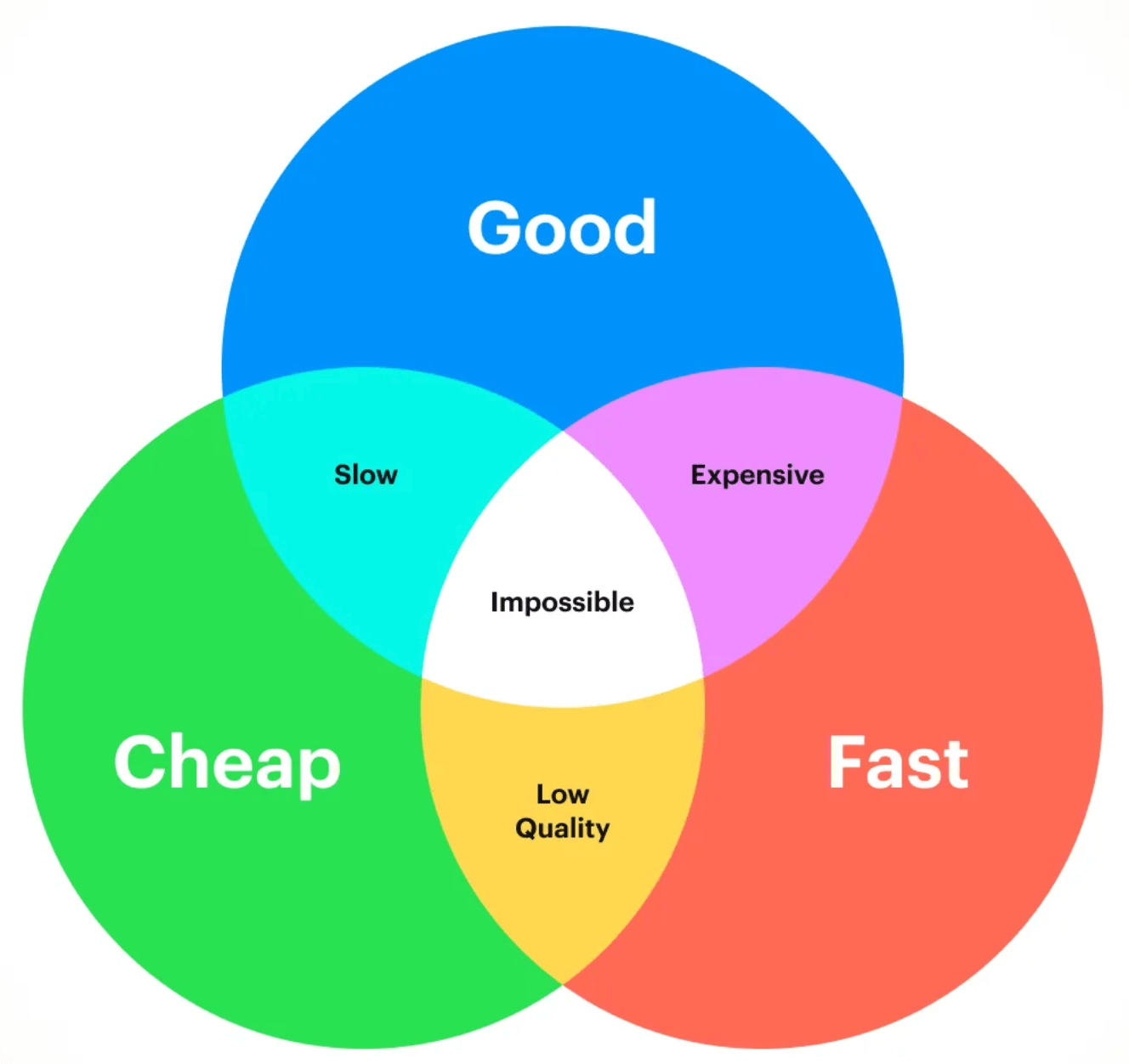

This reminds me of the Iron Triangle which says if you have 3 constraints, you can only pick two. You see this all the time in restaurants where you have good, cheap, and fast. You will never get all 3.

Pre-Trade – Advisory

Many years ago the rage was around robo-advisors and in fact I wrote a blog about it 12 years ago. Robo-advisors, for instance, use data-driven models to provide tailored investment recommendations with minimal human intervention. Sadly, many of the companies I mentioned in that blog post are no longer around or got acquired-hired for their AUM (assets under management). The truth is, if you are managing a clients money they want to talk to someone from time to time. When markets are good people want to discuss new ideas, when markets are bad people need the reassurance that things are going to be okay.

Trade Execution

Once a client has received financial advice, the next critical step is executing the recommended trades. Trade execution in wealth tech refers to the process of buying and selling financial instruments, such as stocks, bonds, and ETFs, based on the advisory guidance provided.

Automation is at the heart of modern trade execution. They can automatically rebalance portfolios, optimize tax efficiency through strategies like tax-loss harvesting, and even execute fractional share trading to make investing more accessible. The focus here is on precision and efficiency, reducing latency in trade execution and ensuring that investors can act quickly to capitalize on market opportunities.

Post-Trade – Data Aggregation and Portfolio Summary

After the trades are executed, WealthTech platforms provide a range of post-trade services that are crucial for ongoing portfolio management. This area includes data aggregation, performance tracking, and portfolio summary services, which together offer clients a comprehensive view of their financial wealth and health.

Data aggregation is the process of consolidating information from various sources, such as brokerage accounts, banks, and financial institutions, into a single platform. This enables clients to have a holistic view of their assets and liabilities, making it easier to track their net worth and assess their financial progress. WealthTech platforms often employ advanced analytics to process this data, offering insights into spending patterns, investment performance, and potential areas for optimization.

What’s Next?

The future of WealthTech lies in the increasing sophistication of these post-trade processes. Artificial intelligence and big data analytics are already being used to create more personalized investment insights, alerting investors to market shifts and opportunities that match their risk profiles and financial goals. This might sound a bit like robo-advisors, but its a combination of technology and real advisors who can interact with the client and deliver the insights.

Conclusion

WealthTech is revolutionizing the financial services industry by breaking down traditional barriers and making wealth management more accessible, efficient, and data-driven. The three pillars of WealthTech—pre-trade, trade execution, and post-trade processes—work together to streamline the investment process for clients across the financial spectrum.

1 Comment