My last blog post was about the rise of wealth in India, specifically among the super wealthy. Several people reached out to me and asked whether most of the families mentioned have a family office set up. Of course, I don’t know with 100% accuracy, but I would imagine that a percentage of them do have a formal family office setup, while the rest are probably contemplating it.

The Quick 101 of a Family Office

A family office is a private organization that manages the financial affairs and investments of a single wealthy family. It provides a wide range of services, including investment management, estate planning, tax services, philanthropy, and administrative support, all tailored to meet the specific needs of the family. Family offices are typically set up by Ultra High Net-Worth Individuals (UHNWI) or families to preserve and grow their wealth across generations, offering a centralized and personalized approach to managing complex financial matters.

Fun Fact: One of the very first family offices was set up by John D. Rockefeller.

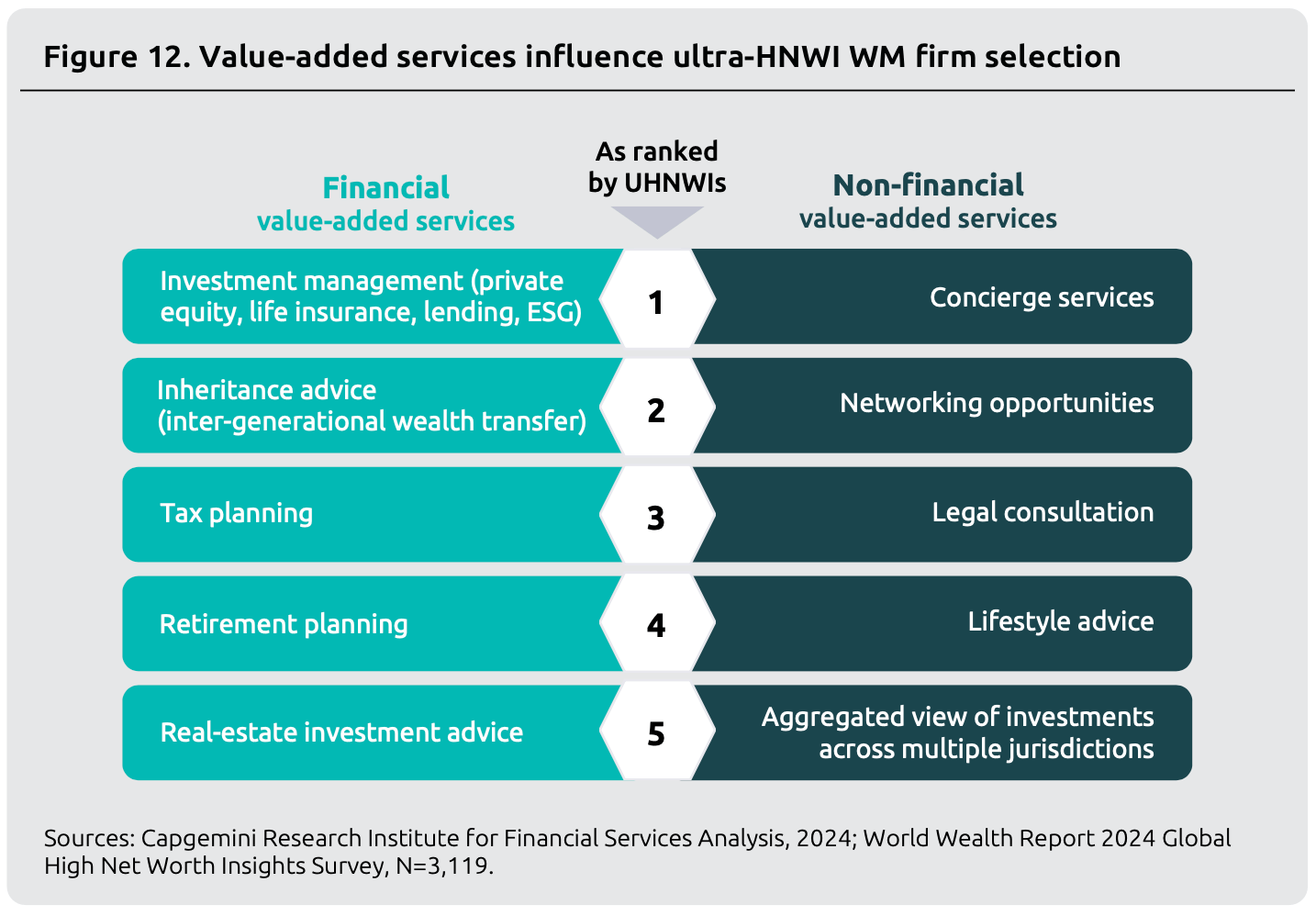

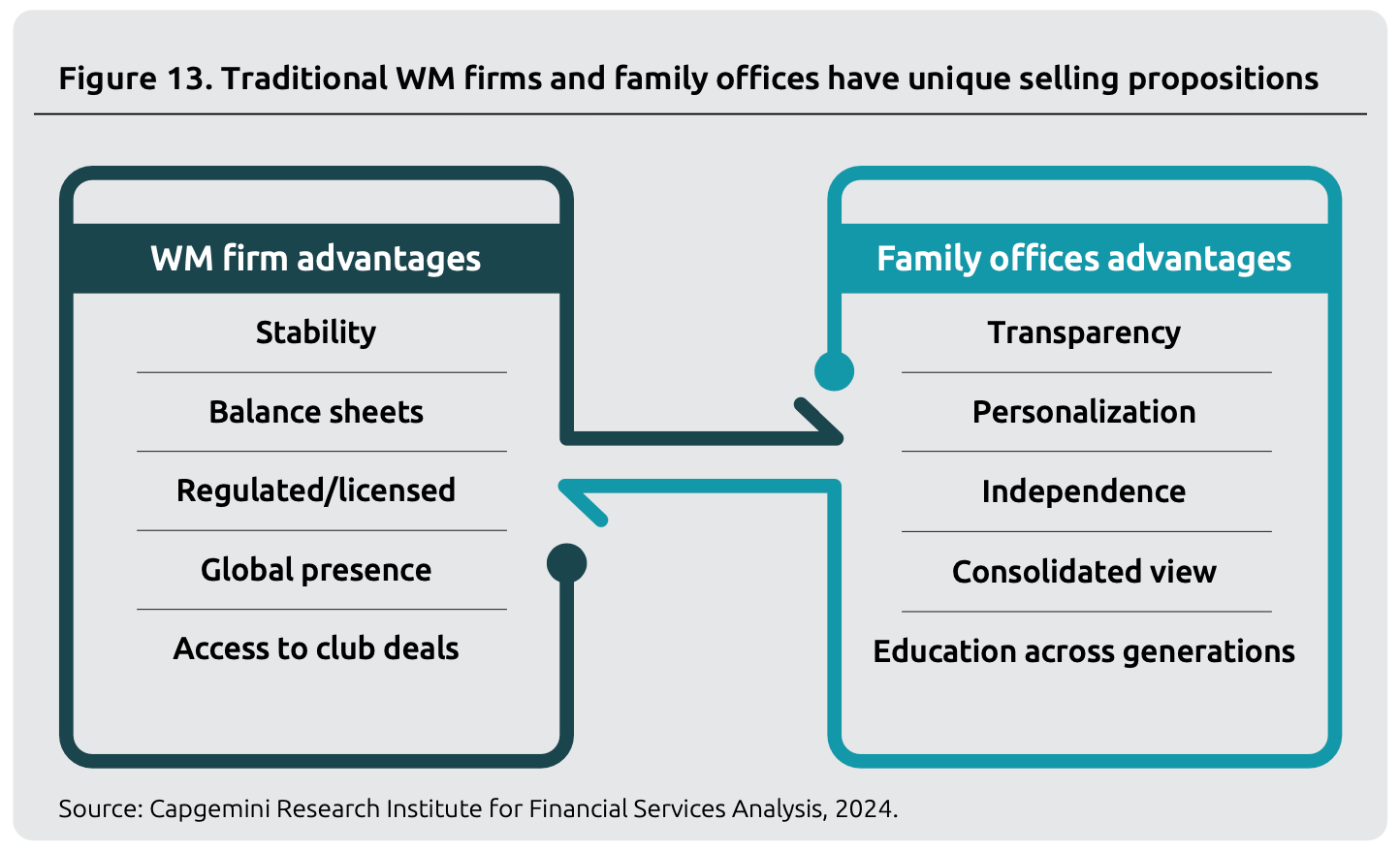

The images below talk about what an UHNWI seeks and also the difference between wealth management firms and family offices.

Various Stages As Wealth Grows

In my many years in the financial services industry in India, I have observed how clients progress through various stages as their wealth grows. Typically, they are first-generation business owners who begin by working with a relationship manager or “wealth advisor” at a large bank. This is a natural choice, as businesses often require access to loans and working capital, leading them to establish strong relationships with banks.

As the years pass and their wealth grows exponentially they look to wealth management firms that only focus on wealth management and investments. These firms are great because one of the main services that families want is investment advice. Although, many of these firms try to cover a wide spectrum of services such as taxation, wills, investments, and philanthropy, it’s often not feasible.

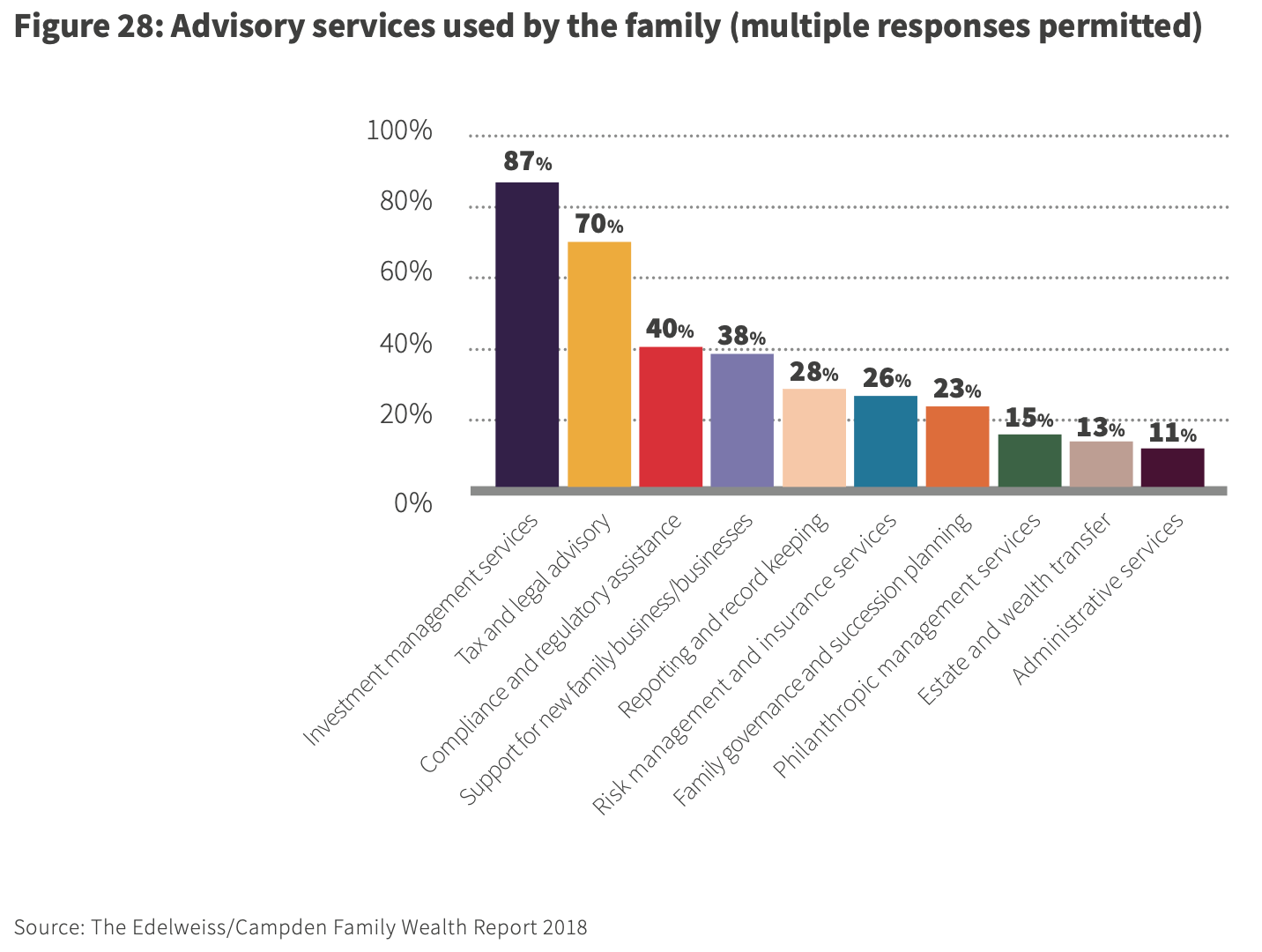

The next stop in their journey is working with a Multi-Family Office (MFO) setup. A MFO is a type of wealth management firm that provides comprehensive financial services to multiple wealthy families, rather than just one. MFOs offer a broad range of services as indicated in the images above. By serving multiple families, MFOs can provide a more cost-effective solution compared to single-family offices, while still offering a high level of personalized service and financial expertise. This structure is particularly appealing to families who seek the benefits of a family office but prefer to share the costs and infrastructure with other like-minded families.

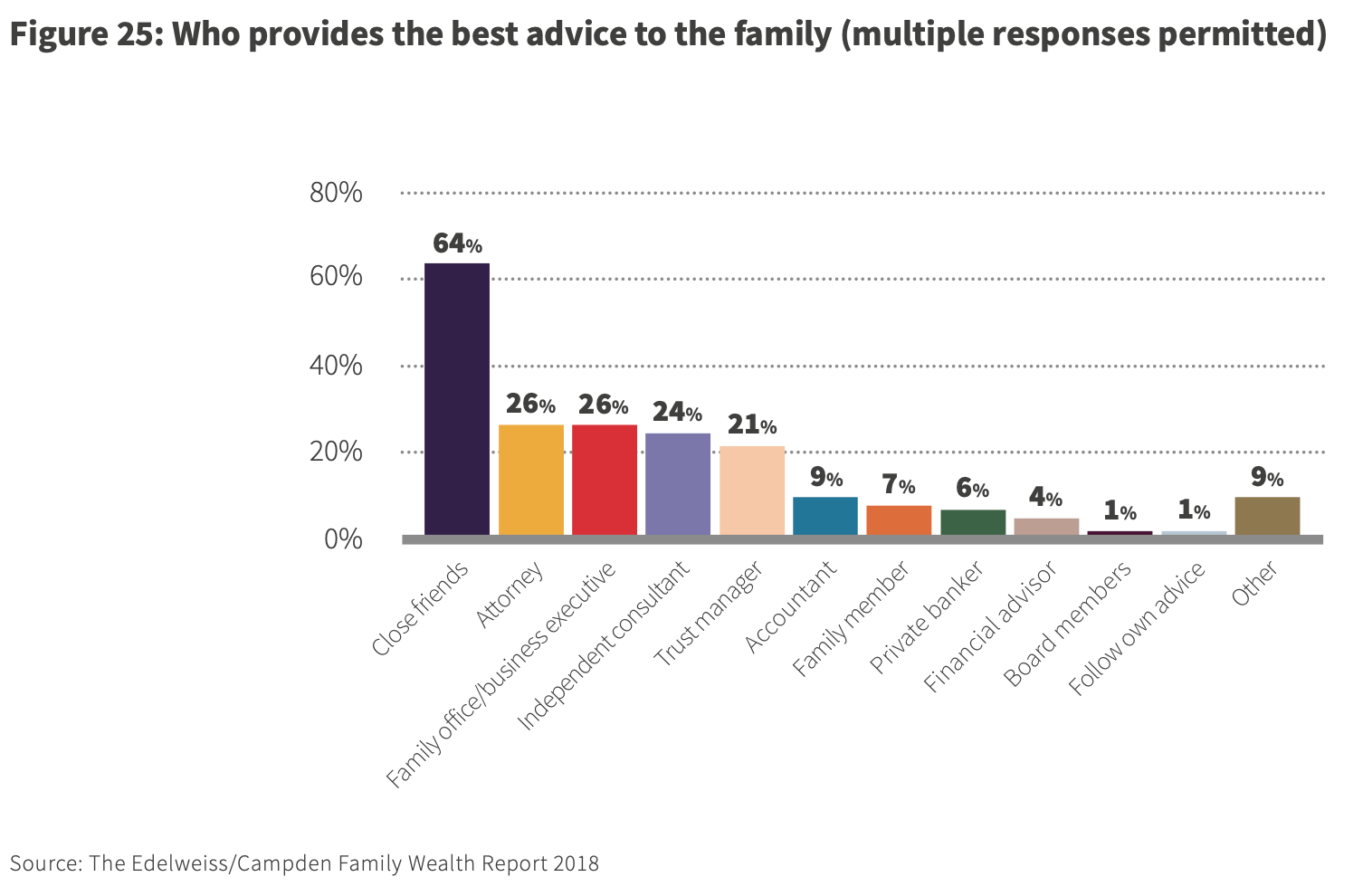

However, once a family has a substantial portfolio of assets, say over Rs. 1,000 crore, there is the option of setting up their own family office. Whether someone uses a relationship manager, a wealth management firm, an MFO, or a single-family office, they all are looking to get advice on many topics not just investment advice. Most striking is the majority of the advice comes from friends. Which shows that even with a professional setup, many people still rely on their existing social circles for guidance on a wide variety of issues that they may encounter as their wealth grows. As the rapper The Notorious B.I.G. famously said in his 1997 hit song, “Mo Money Mo Problems.”

Why the Interest in Family Offices?

If you look back 30 years ago in India, there were not many investment options. As I call it, all that was available was EFGHI – Equity, Fixed Deposits, Gold, Housing and Insurance. And even with that, not many people ventured into equities so it was really just 4 investment options.

Today, there are many options, such as ABCD—AIFs, Bonds, Crypto, and Derivatives. And honestly, that’s just the tip of the iceberg. What about PMS, REITs, InVITs, startups, index funds, G-Secs, etc.? It can be all very confusing for most people who are busy building and running their businesses and cannot dedicate much time to planning for the next generation’s growth. Only a dedicated team, whether in-house or external, can truly do justice to managing these new investment options, tax structures, and more. Which is the reason for the interest in setting up a family office.

1 Comment