Friday, Sept 20th, 2019 will hopefully go down in Indian financial markets as the day the economic boom for the … More

Category: Finance

Jio is Unstoppable

Reliance Industries (RIL) this past week held its 42nd Annual General Meeting (AGM) in Nariman Point. Mukesh Ambani broke the … More

Index Funds Finally Get Some Love in India

I must say, I was pleased to see the headline in the Economic Times talking about investing in index funds … More

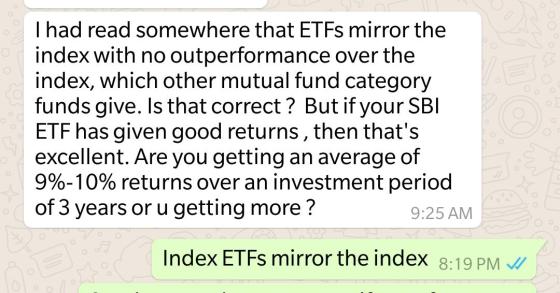

ETFs in India

A cousin of mine who is pretty savvy with the stock market sent the above WhatsApp message to me. I … More

“Hello, World!’ for Quant Traders

This is the second blog post on my journey to learn Machine Learning. My first blog post talked about setting up the … More

The Future of Payments

Earlier this month I had a chance to be on a panel discussing User Experience (UX) for payments. The panel was … More

BharatQR, Another Payment Option?

It’s another day and yet another payment option/technology was launched in India. The newest one to the party is called … More

Modi Marches On

We live in an era of limited attention span, super short news cycles and the upcoming President of the US … More

US and India Taxation

Dear e-commerce expat, So you moved to India to join the e-commerce boom, you get to deliver packages during the … More