Over the past few months, several people have reached out to me with questions about investing in the stock market. It made me realize why people develop a mental block and delay their decision to start investing: it’s confusing as hell. I’ve been investing in the markets since 1985. The first stock I bought was Mesa Limited Partnership (MLP), and I witnessed it get slaughtered in the financial crash of October 1987.

The Man in the Arena

I also invested in the Fidelity Magellan fund during the peak when Peter Lynch was running the fund. Back then Peter was an investment guru and he was the talk of the town till the fund got too big and he could no longer deliver above market returns. That’s when I realized if your fund is too big then you miss out on opportunities that you previously could have invested in to give you stellar returns.

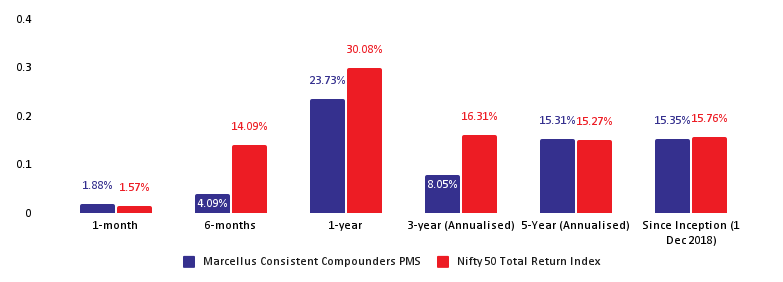

Recently, someone remarked that Saurabh Mukherjea’s flagship PMS product the Marcellus Consistent Compounder has underperformed the Nifty 50 Index since its inception. I’m not here to throw him under the bus, instead I know it’s not easy being in the arena. I’ve been there before when I moved to India in 2005. I was part of a team running an algo trading fund and we would consistently get calls and emails telling us how to trade/invest in the Indian markets since we were foreigners and didn’t have a clue!

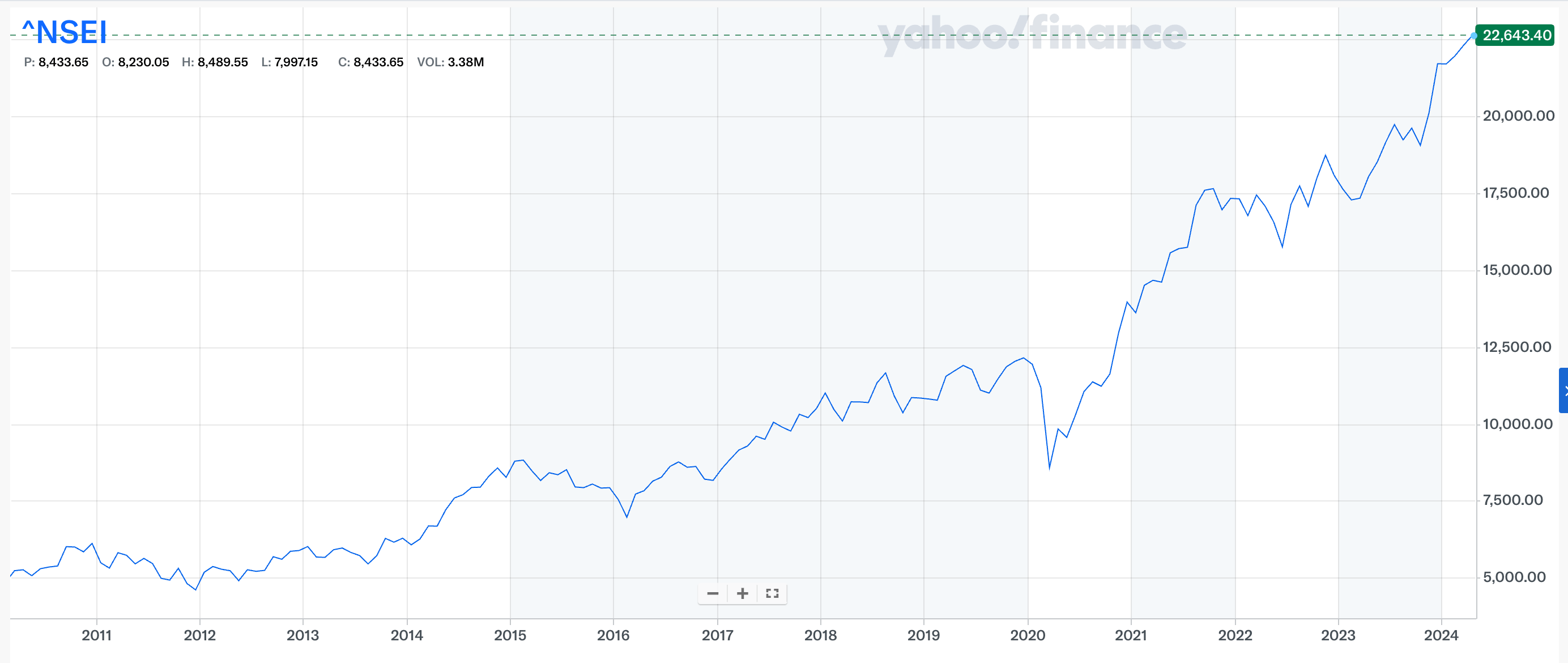

Since then, I have moved away from investing in specific stocks and have become a big believer in index funds. Index funds track the big market indices like the Nasdaq, S&P 500, Nifty or Sensex. When you invest in an index fund of a major stock market index you are essentially betting on a countries future economic growth but NOT sure which specific company or sector will outperform the market.

Index Funds vs. ETFs

Once you make peace with your investment thesis of index funds, you’ll find that people start talking about ETFs, and your brain might go into overdrive trying to analyze the differences between a Nifty Index Fund and a Nifty ETF. I’ve been there many times and have created Excel sheets in the past to compare these two types of investment vehicles. I should have gone back to my first love, which is cars, and realized that it’s like comparing a petrol engine to a diesel engine. In the end, you will reach your destination, and the differences between the two types of engines—or investment products—are merely background noise. I’ve made my peace: index funds are the way to go for 95% of the people reading this blog post. If you are worried about slippage, skid, volatility, and liquidity, you are probably a professional trader. Which brings me to my next question: why in the world are you reading my blog post? Close this browser window and get back to your trading desk.

However, if you are keen to understand the differences between index funds and ETFs, I suggest watching the following by YouTuber Shankar Nath:

Which Index Fund to Choose?

I suggest you start with what I call the core of your long-term equity portfolio and jump straight into a Nifty variant. I say variant because for many years I would tell people to get an HDFC Nifty 50 Index Fund or HDFC Index S&P BSE Sensex Fund. I recommended HDFC because their overall cost was low and it was from a well known financial institution.

However, over the last 5-7 years the market has exploded to include many new products from a wide variety of asset management companies (AMC). Let’s go through four options in order of how many companies they track. The logic is that more companies in the index will give you better coverage of the “India Story.” If you invest in the Nifty 50 Index, you are only focusing on the Top 50 companies based on market cap but what about the 1000s of other companies? Whereas, the Nifty Total Market Index covers 750 companies.

- HDFC Nifty 50 Index – This is the one I have recommended for years. It provides investors with exposure to the 50 largest companies by market capitalization. The total expense ratio (TER) is 20 bps or 0.20%

- Zerodha Nifty LargeMidcap 250 Index Fund – This index fund follows the Nifty LargeMidcap 250, and invests your money equally between the top 100 large companies and the next 150 midcap companies. The TER is 25 bps or 0.25%

- Motilal Oswal Nifty 500 – It represents the top 500 companies in India that cover more than 90% of India’s listed market cap companies and includes a wide range of companies spanning large-cap, mid-cap and small-cap segments. The TER was recently reduced to 13 bps or 0.13%

- Groww Nifty Total Market Index Fund – Stocks that are a part of the Nifty 500 index and the Nifty Microcap 250 index form a part of the Nifty Total market Index. represents 750 stocks listed on the National Stock Exchange (NSE). The index tracks the performance of these 750 stocks across sectors and market caps, including large cap, mid cap, small cap and micro cap segments. The TER is 25 bps or 0.25%

My Personal Recommendation

If you pick any one of the four you can’t go wrong. The four options are like comparing a Mercedes C-Class, Audi A4, and BMW 3 Series. All three are safe German cars and each has some slight nuances, but overall any one of them is a good pick.

However, if I had to pick one – I would invest in the Motilal Oswal Nifty 500 and forget about it. It covers the top 500 Indian companies and the recent reduction in the expense ratio makes it a very attractive option.

The image below was part of a brilliant advertising campaign from DSP Mutual Fund and I think it really sums up what you need to do.