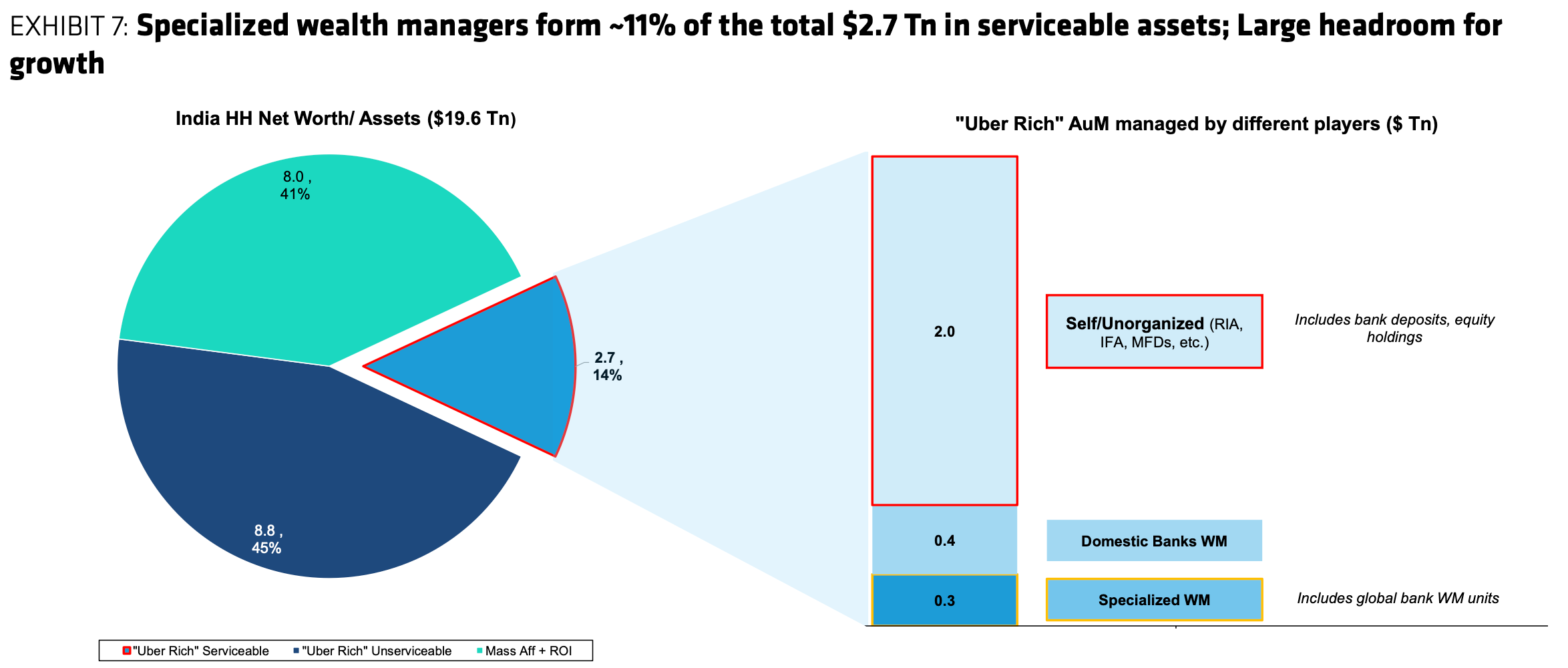

I was recently diving into a detailed report from Bernstein about the state of wealth in India, and one number really jumped out at me: $2.7 trillion. That is the estimated liquid financial wealth held by India’s “uber-rich” today. I have read many research reports but this is one of the best that clearly lays out the rise of the uber wealthy.

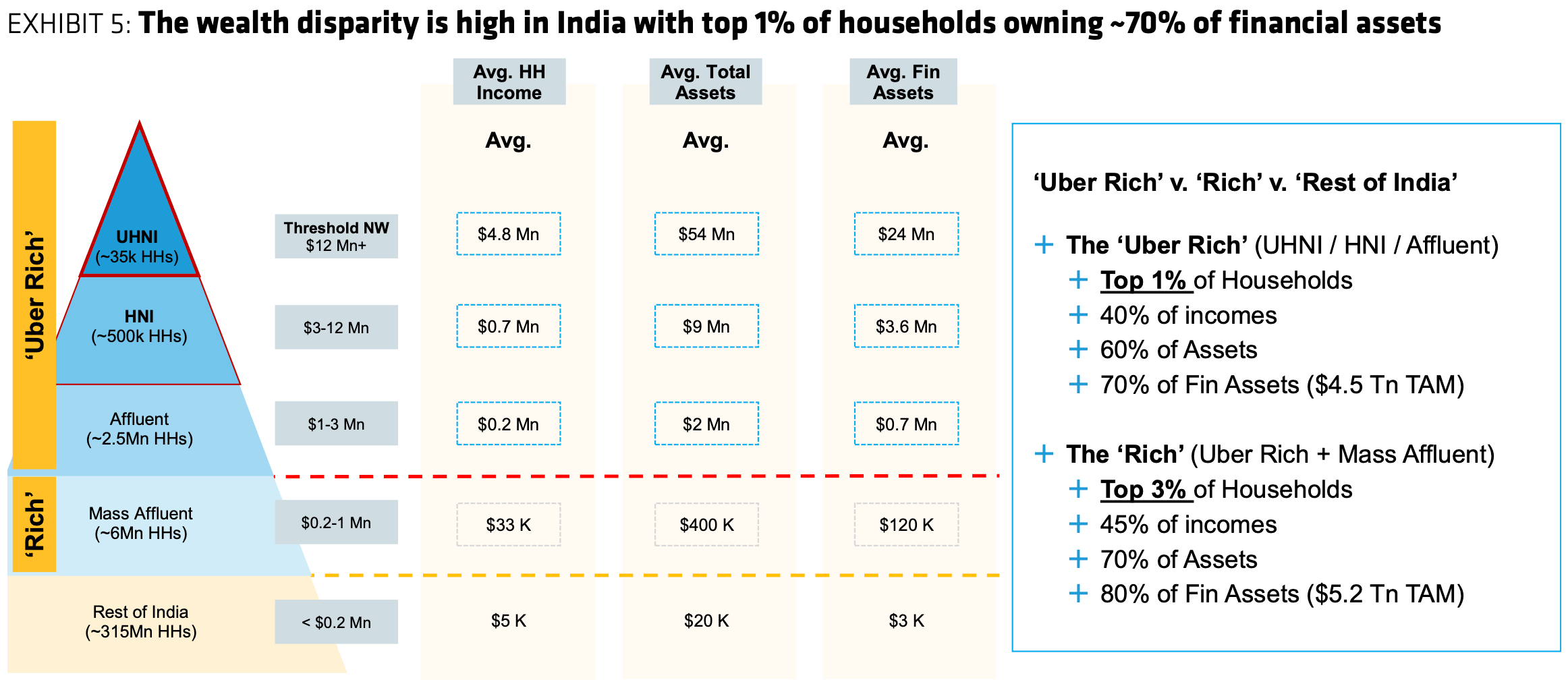

At MProfit, I spend a lot of time thinking about how HNIs and Family Offices track their investments. We often talk about the “democratization of finance,” but the reality on the ground is that wealth in India is becoming incredibly concentrated at the very top. According to Bernstein, the top 1% of households in India now control roughly 60% of the total wealth.

Let that sink in for a bit.

We are seeing a massive explosion in the organized wealth space, driven by an estimated 3 million households that fall into the “uber-rich” category. For years, the conventional wisdom was that India’s wealthy kept their money in “dead” assets—mostly gold and land. But there is a fundamental shift happening right now. We are moving away from physical assets and toward financial ones like equities and bonds.

Why is this happening now? It’s not just about the old-school industrial families anymore. The report highlights that a huge chunk of this new wealth is being minted in the startup ecosystem through founders cashing out or employees exercising ESOPs. Add to that the recent capital market boom—think IPOs and stake sales—and you have a recipe for a brand-new class of ultra-high-net-worth individuals (UHNIs).

Currently, India ranks #3 globally in the number of billionaires and #4 in individuals with a net worth over $10 million. The report breaks this down into three distinct tiers:

- UHNIs: Those with a net worth over $12 million (averaging around $55 million).

- HNIs: The $3 million to $12 million bracket.

- Affluent: Those in the $1 million to $3 million range.

What’s interesting is that despite these massive numbers, most of this wealth is still “unorganized.” It’s either self-managed or handled by unorganized players. As product complexity grows and return expectations rise, these 3 million households are finally starting to look for professional advice.

Bottomline: The “rich getting richer” is a global trend, but in India, it’s being supercharged by a move toward financialization. We are no longer just a nation of savers; we are becoming a nation of sophisticated investors. The question is no longer whether the wealth exists—it’s about where all that capital flows next.