Since the official launch of Account Aggregator (AA) in September 2021, much has been written about what it can do. … More

Category: Finance

The DeFi Revolution, Part 1

I was approached 3 months ago to give a presentation on DeFi. Back then I couldn’t even spell DeFi much … More

Dumb Pipes + Smart Owner = Jio

Wow! That is all I can say when you look at the investments that Mukesh Ambani has received for Jio … More

Charts, Charts and More Charts

This blog post has been pending for the past 3 or 4 months, but with today’s implosion in Yes Bank … More

Passive Investing and Asset Allocation

I’m not sure what has flipped the switch but it appears everyone in India is talking about the rise of … More

The Rally that Left Manpasand Behind

Friday, Sept 20th, 2019 will hopefully go down in Indian financial markets as the day the economic boom for the … More

Jio is Unstoppable

Reliance Industries (RIL) this past week held its 42nd Annual General Meeting (AGM) in Nariman Point. Mukesh Ambani broke the … More

Index Funds Finally Get Some Love in India

I must say, I was pleased to see the headline in the Economic Times talking about investing in index funds … More

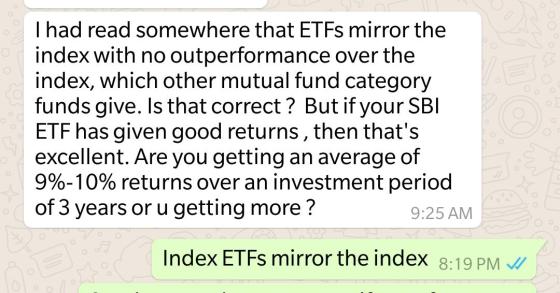

ETFs in India

A cousin of mine who is pretty savvy with the stock market sent the above WhatsApp message to me. I … More