If you are a fan of watching financial markets as a sport then the past 4 days have been action packed with all sorts of hail marys. As of now 3 of the 5 investment banks are gone – Bear, Merrill and Lehman. That leaves only Morgan Stanley and Goldman Sachs as the last of the true independent broker/dealer/investment banks. I’m guessing in short order they will be folded into a bank, although I bet Goldman buys a bank. What we are seeing in the financial markets is the equivalent of the dot com implosion. Stock prices almost going to zero, back in March 2007 Lehman (LEH) traded as high as USD 85 with a market cap of USD 46 billion, today it’s trading at 21 cents with a market cap of USD 145 million – DOWN 99.75%.

If you are a fan of watching financial markets as a sport then the past 4 days have been action packed with all sorts of hail marys. As of now 3 of the 5 investment banks are gone – Bear, Merrill and Lehman. That leaves only Morgan Stanley and Goldman Sachs as the last of the true independent broker/dealer/investment banks. I’m guessing in short order they will be folded into a bank, although I bet Goldman buys a bank. What we are seeing in the financial markets is the equivalent of the dot com implosion. Stock prices almost going to zero, back in March 2007 Lehman (LEH) traded as high as USD 85 with a market cap of USD 46 billion, today it’s trading at 21 cents with a market cap of USD 145 million – DOWN 99.75%.

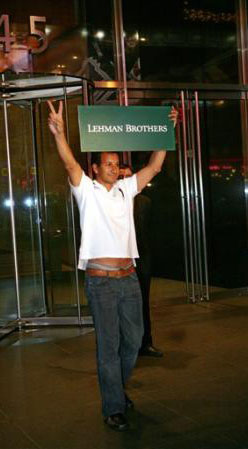

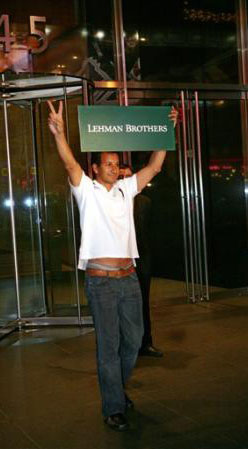

Locally in India, Lehman who recently moved into arguably the most expensive office building in India, Ceejay House, has already shut down part of their operations. The broker/dealer arm is still going, but most people will not trade with them and that’s the death knell for a broker.

One of Merrill’s top guys Andrew Holland has jumped ship to Ambit Capital to head institutional equities and run their prop book. DSP Merrill Lynch Mutual Fund will now be renamed DSP BlackRock Mutual Fund.

The biggest winner from all this carnage is probably Hemendra Kothari who sold out a major chunk to Merrill back in December 2005 for USD 500 million.