Back in November 2020, I bought the new iPhone 12 mini and as I was paying for the phone, the sales guy said I could buy it via the “no cost EMI” (EMI – estimated monthly installment) option. In my mind, no cost EMI means that I could either pay for the phone out right at Rs. 69,900 on that day or over the course of 6 months, my monthly payments, interest and fees would also add up to Rs. 69,900…hence no cost EMI. Well, that’s not exactly how it panned out.

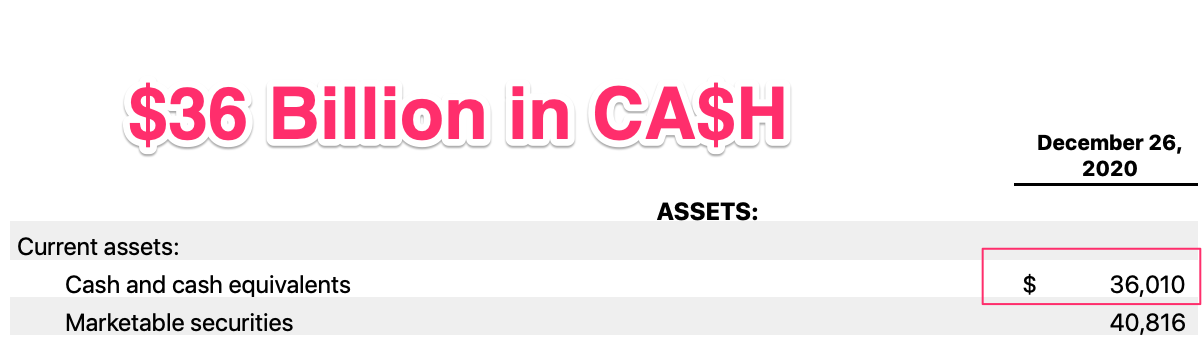

Before I get to the calculations, the first question is why would the bank offer a “no cost EMI” option…isn’t that their main purpose to loan money to people and make money on the interest payments? Yes, that is correct. However, some companies like Apple have a lot of money on their balance sheet and don’t mind lending their own money to consumers to help them buy Apple products. This way Apple can sell more product and also make use of that cash that otherwise is just sitting in mostly US treasury bills earning very little interest.

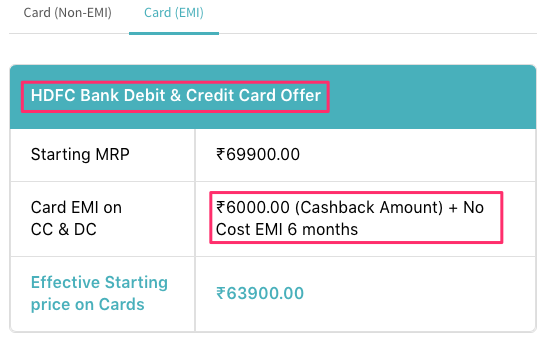

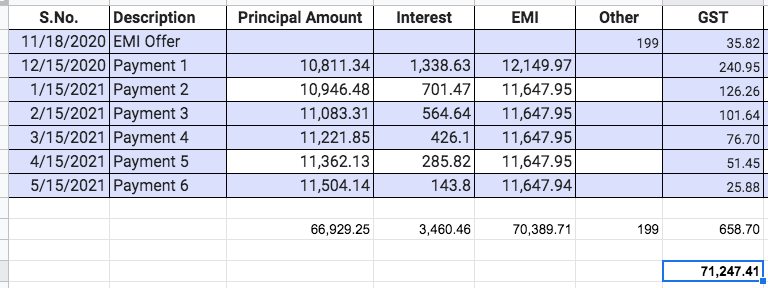

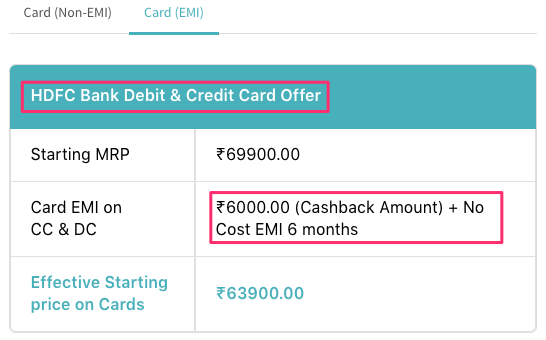

So the offer that was presented to me was actually 2 offers in 1, one was a “no cost EMI” and second was Rs 6,000 cash back after several months. I figured I would try this “no cost EMI” option because I knew I was getting back Rs. 6,000 anyways and what is the worst the “no cost EMI” would cost me. After everything was said and done the “no cost EMI” actually was Rs 71,247.41 so an extra Rs. 1,347. The extra cost was the initial Rs. 199 enrollment fee and the GST on the enrollment fee and the interest component, which is just stupid. They really should have included those costs as well so that the final price for a “no cost EMI” would be Rs. 69,900 then it would have been truth in advertising.

Of course, I also kept that money in the bank and it was getting 4% interest. That means I got about Rs. 820 in interest since I didn’t have to pay for the phone upfront. The only saving grace is that in a couple months, I will get a Rs. 6,000 refund. Which means the phone after everything is said and done cost me:

Rs. 69,900 (iPhone) + Rs. 1,347 (extra EMI charges) – Rs. 6,000 (HDFC offer) – Rs. 820 (interest from my bank) = Rs. 64,427.

Personally, RBI should regulate these so called “no cost EMIs” and ensure there are NO additional costs when comparing it to a flat out purchase. Now that I know there are some additional costs associated with “no cost EMIs”, next time I’ll just pay for it upfront and be done with it.

As a side note, when I said Apple has lots of money I should have mentioned it has the MOST cash on hand of any company in the world. It currently has around $200 billion in cash and other investments on its balance sheet. $$$.

This was really helpful. We bought a TV with this no cost EMI scheme and had no clue how this scheme works. It’s a very smart marketing move which still works best to dupe consumers