First, let’s set the context of what a super app is. It’s typically a mobile app that can provide multiple services including payment processing. Super apps have done very well in China where WeChat and Alipay have the majority of marketshare. In India, Paytm tried going down the super app route but it didn’t go so well, so it’s back to really just being a payment app and mainly for UPI transactions.

Tata Neu

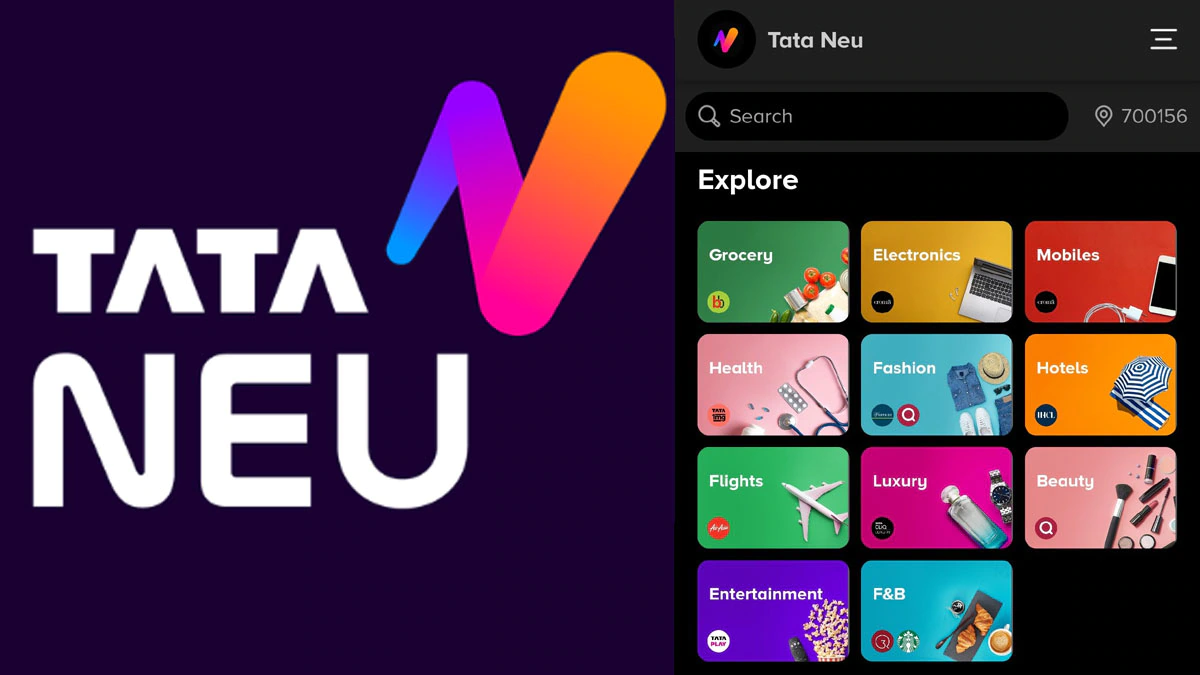

Early this year, the Tata Group launched their super app called Tata Neu. The Tata Group is the largest conglomerate in India and has many different products and services. Taj Hotels, Air India, Vistara, Tata AIG Insurance, Tata Motors, Jaguar Land Rover, Tetley, Tata Starbucks, Westside, Tanishq, 1mg, BigBasket, and probably another 75 more brands.

There are 2 ways to make a super app successful:

- Build an app that has many services and hope millions of customers flock to the app

- If you have many products and millions of customers, build an app to cater to them

The Tata’s are making a bet with #2 by having their customers converge onto a single app and then cross-sell them. Will someone that stays at Taj Hotels want to buy clothing from Westside? Well, that’s the bet they are taking.

I personally feel this is a great initiative to get all the Tata brands to talk to each other and not have individual silos of customer data. Can you imagine if you downloaded the app and your Taj points or BigBasket info was not there. You would tell Tata Neu and then the Neu team would have to work with the respective Tata brands to get this information pipeline working. I imagine before the Tate Neu app each Tata company would push back saying they couldn’t do it or blah, blah, blah…now the consumer is saying “where the hell is my data?”

With all the products and services that the Tata Group, their ability to build an accurate profile of your purchasing history, demographic data, what you like, and where you visit is something that most marketing companies can only dream of. I personally think the Tata’s can pull it off because they have so many products, services, and a stellar reputation.

Fintech Super Apps

This past week I attended the Global Fintech Fest and there was a session on super apps for the financial services industry. The panel had several officials from the largest banks in India and discussing the need for a super app. I kinda laughed because if you have used ANY banking app in India, you know how pathetic the overall user experience is.

Before the banks start to talk about super apps, they first need to change their internal mindset of what they do and who is their target audience. Several years ago, I attended a startup event where Munish Mittal the CIO of HDFC Bank at the time was speaking and so proudly said they have 25-30 outsourced technology vendors they use. It shows, because many of the HDFC products are not connected when you login and the overall look and feel is very different from product to product.

But there is hope, Kotak Bank recently hired a CTO…yes CTO not CIO. That is a huge step forward to realize you need to hire a Technology Officer and not an Information Officer. This is the first big Indian bank to appoint a CTO. Everyone is spoiled by the superb app experiences from companies like Swiggy, Ola, and Amazon. I feel this will force other banks to revisit this since the world is moving to a digital payments environment and you need to have an overall great app experience.