Recently, a buddy of mine Jatin K. (@jatinkarani) bought an electric vehicle (EV). He ended up buying the Tata Nexon … More

Category: India

Amazon’s Private Label Business

Like many of us during this pandemic, I have a browser tab open for Amazon.in so I can buy stuff … More

Virus – Corona or WhatsApp?

WTF. Just a month ago, stock markets around the world were hitting all-time highs. The bellwether US S&P 500 index … More

Passive Investing and Asset Allocation

I’m not sure what has flipped the switch but it appears everyone in India is talking about the rise of … More

Jio is Unstoppable

Reliance Industries (RIL) this past week held its 42nd Annual General Meeting (AGM) in Nariman Point. Mukesh Ambani broke the … More

Incredibly Inept India

Last month I had the chance to visit the Bandhavgarh National Park in Madhya Pradesh (MP) for a tiger safari … More

Index Funds Finally Get Some Love in India

I must say, I was pleased to see the headline in the Economic Times talking about investing in index funds … More

Taxes, Tariffs, and Testarossas

A couple of days ago there was an article in the DNA newspaper, an Indian daily, discussing how the high … More

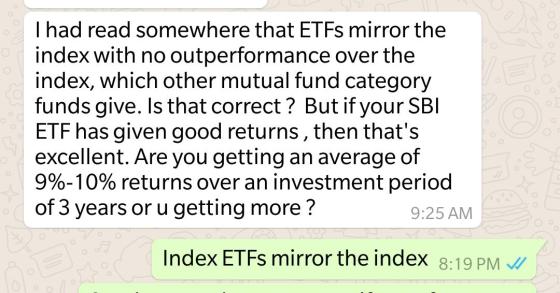

ETFs in India

A cousin of mine who is pretty savvy with the stock market sent the above WhatsApp message to me. I … More